“What’s a scam that’s become so normalised that we don’t even realise it’s a scam anymore?”. So starts a viral TikTok that goes on to highlight the ever increasing costs of student debt. Other users have taken the prompt to stitch their own videos and provide their examples of what they think are scams. Hospital bills, funeral homes, the fashion industry, wellness, and society’s relationship with alcohol all feature. One that doesn’t, perhaps because it’s so insidiously entrenched that peopled don’t even think about it, is the cost of sending money to a loved one abroad. One in nine people around the world are supported by funds sent to them by migrant workers. Half that money goes to rural communities where the word’s poorest people live. These payments, called remittances, are a vital lifeline for many. They are also the reason so many workers make the hard choice to leave their families and communities behind to forge a new life in new surroundings. And yet they remain extortionately expensive. Each transaction of this hard earned, desperately needed money attracts fees in the region of seven percent, or over ten percent to large parts of sub-Saharan Africa. How did we get here when we can send an amusing video of a cat containing thousands of times more data than the payment instruction for effectively nothing, and yet the tiny amount of text based information required to send a payment extracts such a large rent?

The answer, frustratingly, is not a simple one. One, for sure, is the profit that money transfer businesses extract from their customers. They get you every which way. A fee to send the money. A hidden fee by providing you with a rubbish forex rate. Want to actually use the money? There’s a withdrawal fee for that. Got more than you were expecting? There’s a fee for being over your expected account limit. ‘Purpose driven’ Western Union, who returned more than $700m to shareholders from revenue of just over $5bn in 2021 and charge an average of “around 5%” per transaction lay out the risk in their annual report. They worry that regulation could “adversely affect their financial results” as “price reductions generally reduce margins and adversely affect financial results in the short term and may also adversely affect financial results in the long term if transaction volumes do not increase sufficiently” [sic]. Conspicuously absent from their environmental and sustainable governance report is any mention of the UN’s 10th sustainable development goal which aims to reduce the average remittance cost to below 3%.

However, simply picking on the transfer agents is unfair. There are costs through the whole system. The agents use a network of banks who each take their cut. Regulatory requirements differ by country but include the need to ensure the sender and receiver are known and not on terrorist watch lists adds an extra burden. The infrastructure underpinning it all was cutting edge at some point in the 60s but adds cumbersome costs now. Operating across different time zones presents its own challenges.

Live view from inside AN Other Bank’s core banking system

Central Bank Digital Currencies (CBDCs) present a rare opportunity to address this problem, and policy makers have taken note. The ECB recently released a paper on the ‘holy grail’ of cross-border payments, and The Bank of International Settlements have also highlighting the opportunity. The ECB define that holy grail as payments that are “immediate, cheap, universal, and settled in a secure settlement medium”. A secure settlement medium essentially meaning that the currency isn’t subject to huge fluctuations or instant collapse like the unfortunate holders of certain so-called stablecoins recently. They argue this is within reach in the next decade. Interestingly, the ECB also notes, positively, that CBDCs – as opposed to Meta’s Libra which we explored in a previous post – expressly ‘preserves the dominant power of existing issuers’ – i.e. preserves the powers of the governments that issue legal currencies today and prevents the private sector from stepping on their turf.

There are several reasons that CBDCs present this opportunity, but three in particular stand out:

- Because they can run on new hardware and software, they can leave behind the legacy complexity that gums up the existing system

- As they don’t yet exist, they can be designed cooperatively by central banks from the ground up to interlink, for example through the agreement of common data standards, security architecture and other similar features. Early experiments in this regard have already been conducted by some central banks.

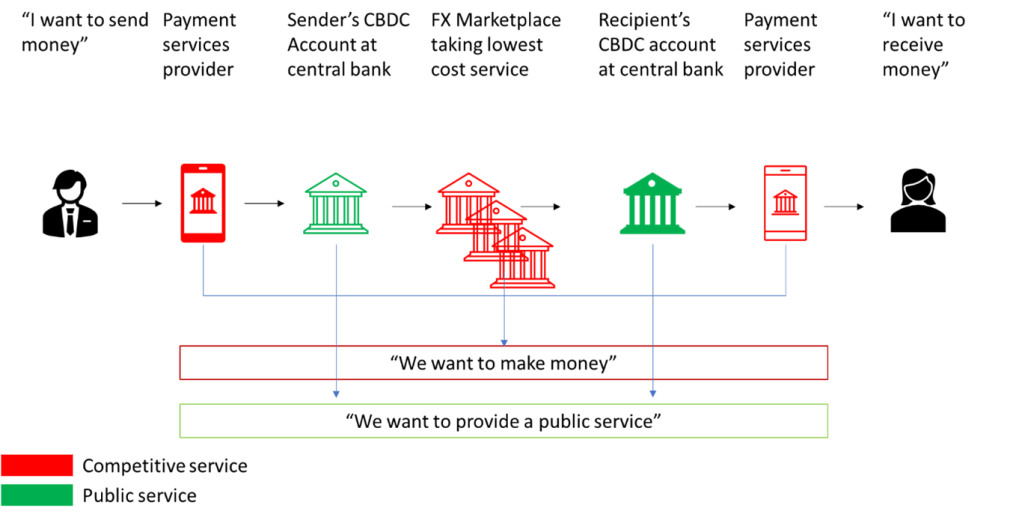

- Central banks can design CBDCs in a way that allows for competition facing the user i.e. multiple payment service providers competing to be the front-end onto your CBDC account at the central bank – perhaps even with a mandated ‘free tier’. Similarly, central banks can mandate competition and in the middle by allowing a marketplace of FX providers each competing to provide you with the lowest cost option.

Illustrative example of how a competitive cross-border CBDC ecosystem might reduce costs

Of course these benefits do not just accrue to remittances. While they are some of the most egregious examples of under-served customers, everyone, from businesses through to citizens could benefit from the ability to more cheaply, easily and rapidly use foreign currencies. For the poor, CBDCs are not a panacea. They come with their own risks and downsides, and many customers will still be digitally excluded as they can’t afford a mobile phone or lack a state ID necessary to register with a payment provider. However, the current system operates to enrich the rich at the expense of the poor. Anything we can do to try and address that most obvious of scams is surely worth considering.

BRIEFLY NOTED

- Use of cash may be increasing again as people use it to help manage their spending in the face of rampant inflation

- Everyone’s favourite drug-pushers on whether banks should look to modernise their core banking infrastructure

- The vampire squid attempt to frame the future of Web 3.0

- BIS on CBDCs and financial inclusion

Leave a comment